Insights

Multiple Equilibria

March 11, 2022

It seems like yesteryear when a global pandemic and transitory language dominated the airwaves. Only a world war could make COVID’s six million deaths seem inconsequential. The atrocities abroad have highlighted how intertwined our world has become. The markets, as of this writing, continue to make new corrective lows with the S&P off by approximately 12% and the NASDAQ -18%, respectively, for 2022. Governments have moved swiftly to decry the actions of Russia’s dictator and corporations have implemented “shadow sanctions”, but not without cost. Oil and other commodities continue on a wild ride while wheat is at record levels (All Russian exports). Only a short time ago, it was the 11th largest economy, and now it has become an uninvestable state, freezing billions of dollars in global capital, with the reverberations felt for years to come. The indices have yet to price in the true global impact of what’s unfolding.

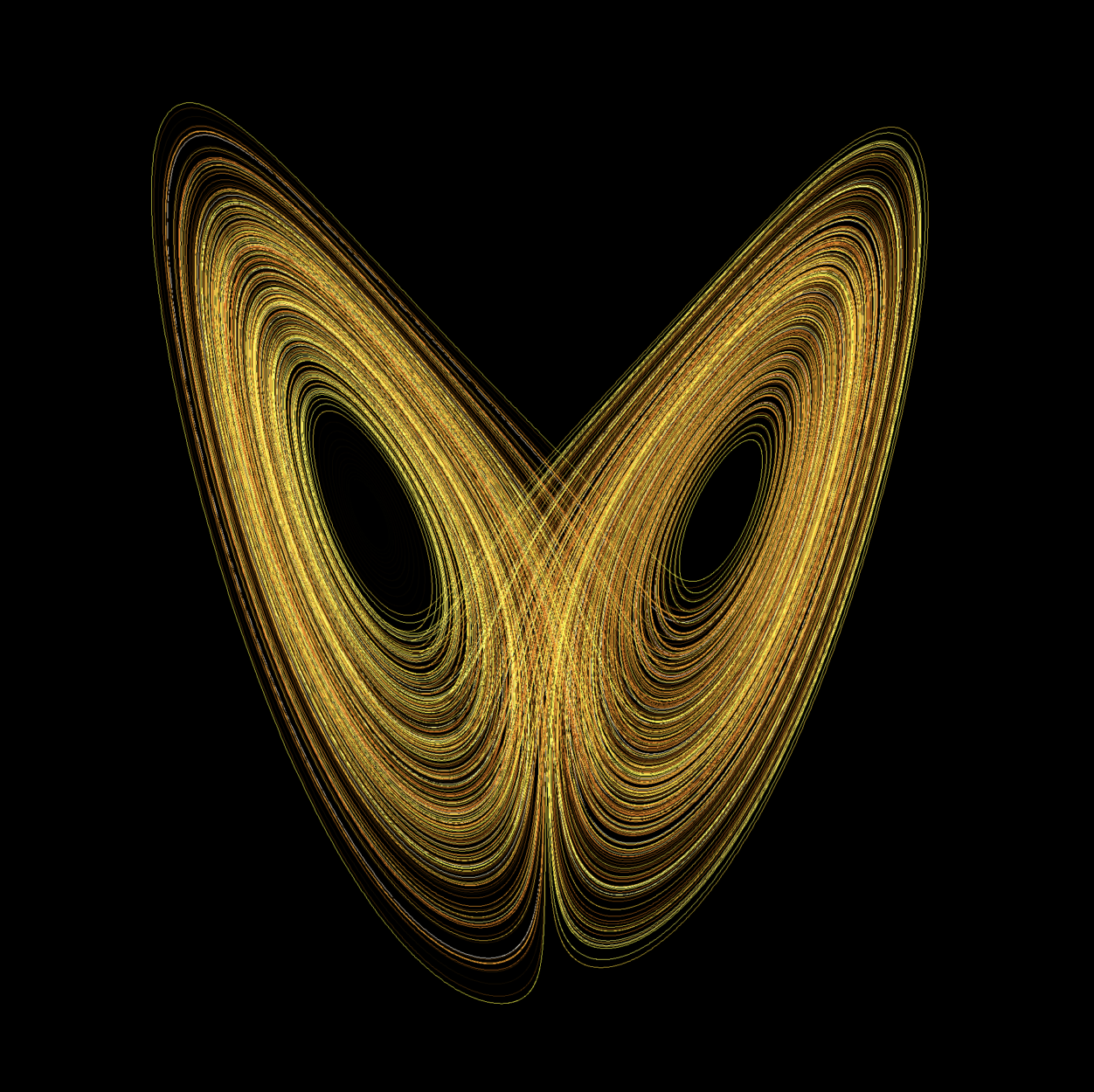

The confluence of demand destruction at play, fragility in global supply chains and the socio-economic implications of food insecurity in developing countries to cyber-security in the developed world, suggests an arduous road ahead. In a matter of 15 days, the Fed’s model has evolved from an organized decision tree to a complex neural network. With CPI currently at 7.9% and rising, a leaking liquidity faucet and structural changes in the market where there’s little risk absorption capacity, the probability of greater distress ahead is all but likely. History tells us that periods with such dynamics precede recessions 77% of the time. The silver lining, of course, is that disruption is always a catalyst for change.

In this moment, sustainable organizations have the ability to shift mindsets away from short-term outcomes to focus on their growth multiple, the ability to create long-term value by systematically changing the way they use data and analytics to drive decision making, where data trumps hierarchy. As the world's largest asset class with the greatest real-world impact, real estate still lacks technological adoption, data standardization and interoperability across systems. The industry operates as proverbial outlaws, neither bound by the rules of the market nor protected by them. Fortuitously, at the speed in which the world is moving, the built world is being pushed through digital transformation.

Once viewed as tools, modern data architectures can and should now be viewed as partners. Raw data alone does not create value, it’s the collaboration between real estate investors and technology that will turn data into actionable insights, assist in identifying new opportunities, build climate intelligence and drive value for the consumers of space. As the markets reach an inflection point, being proactive, by definition creating or controlling a situation, rather than reactive will be a competitive advantage. We are in a time of unprecedented complexity, strategies that may have contributed to a firm's success previously could potentially be the cause of failure in the future. Innovation is the key to staying relevant.

Happy Birthday Raccord!